When renting, most people don’t believe they need to invest in renters insurance either because they think it’s just another added cost or they think their landlord’s insurance will cover them. Unfortunately, that isn’t the case. We’re here to break down the most common myths of Renter’s Insurance and help you understand why you do need it.

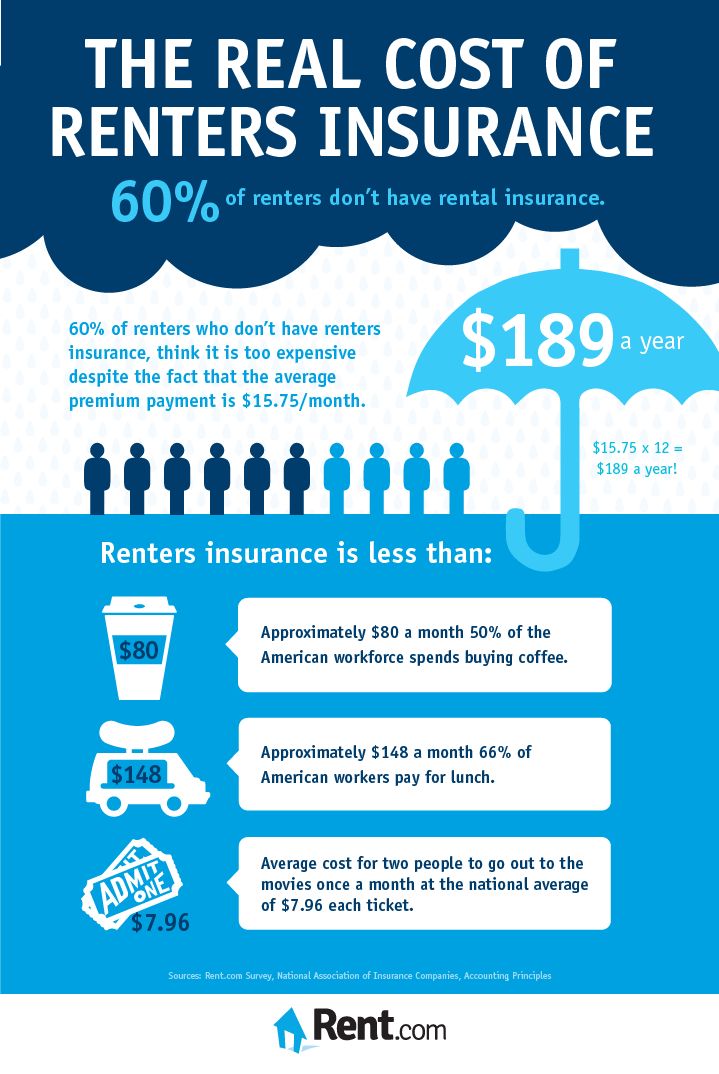

Myth 1. Renters Insurance is too Expensive

This is probably the most common myth. Often times renters see renters insurance as another added cost they don’t want to fit into their budget. However, the average cost of renters insurance usually costs less than $20 dollars a month. If you add up your daily Starbucks a couple of days a month or went out to eat one less lunch, you could easily pay for your renters insurance and peace of mind.

Most insurance companies will also offer a multi-policy discount which makes your monthly payment even more affordable. We still suggest shopping around because just as with homeowner’s insurance, you want to get a good price for your coverage.

Myth 2. My Landlord will Cover Property Damages

Not necessarily. Just because you’re renting their space, doesn’t mean your landlord’s policy will cover the cost of your belongings. Typically, their policy only covers the building itself if something happens. This means if your space floods or a fire breaks out, their insurance will cover the cost of the building, but you’re on your own for replacing or repairing your belongings. As a result, you end up spending more money to replace clothes, furniture, electronics, and even food than the renters insurance actually costs you. You could have prevented the mass cost of replacing all those items by just investing less than $20 a month on proper insurance.

Besides, most landlords in Michigan and throughout the U.S. do require their tenants to carry a proper renters insurance policy. Which means, you need it!

Myth 3. I Don’t Own a Lot

Oftentimes, renters will underestimate the value of their items. If you were to sit down and write up a spreadsheet of what your belongings cost, you might be surprised. Your insurance covers everything from your clothes, food, furniture, electronics, appliances, expensive jewelry, and more. You can pick your insurance plan if you want coverage on everything or specific items. Once your insurance is in place it will cover everything from theft, floods, natural disaster, and guest injuries.

Myth 4. What’s Covered?

Renters insurance covers more than just your personal belongings. Do you live above someone? What happens if your tub overflows and leaks through to your neighbor downstairs? Renters insurance comes in handy because it will help cover the cost up to your liability limit. If someone is injured in your space and has to go to the hospital, your insurance would not only help cover the cost of their medical expenses but legal expenses as well if necessary.

We suggest you sit down and make a list of all your items and estimate how much they cost. Everything from major appliances down to dishes and further down to your toothbrush. You’ll be amazed at how quickly everything adds up and how much value you have in your home.

Ready to invest in protecting yourself? Michigan renters or soon-to-be renters can call one of our Grand Rapids agents at 616-245-5555 and they will be more than happy to walk you through the process and shop around 20 of the top insurance providers to find the best rate with the best service for you. Get covered before it’s too late.

Get A Renters & Auto Bundle Quote To Save On Average $796/Year