There is often a lot of confusion about what a prorated premium is, especially when it comes to your insurance. Your prorated insurance rate is determined based on when you make the change during your term and your billing cycle.

What Causes Prorated Premiums?

Whenever a policyholder decides to make a change to their auto policy, their premium is prorated. Changes can vary from adding a car, adding a driver, changing cars, making changes to your current coverage, or qualifying for different discounts.

Breaking Down Prorated Insurance Rates

Lump-Sum Payments

If you pay your premium in 1 large payment, you are charged another lump sum payment for your change but only for the time left on your policy. If you pay $600 all at once for your red car for a 6-month policy ($100/month) and you add a blue car that costs $50/month two months into your term, you’ll pay $50 x 4 months (time left on your term), or $200.

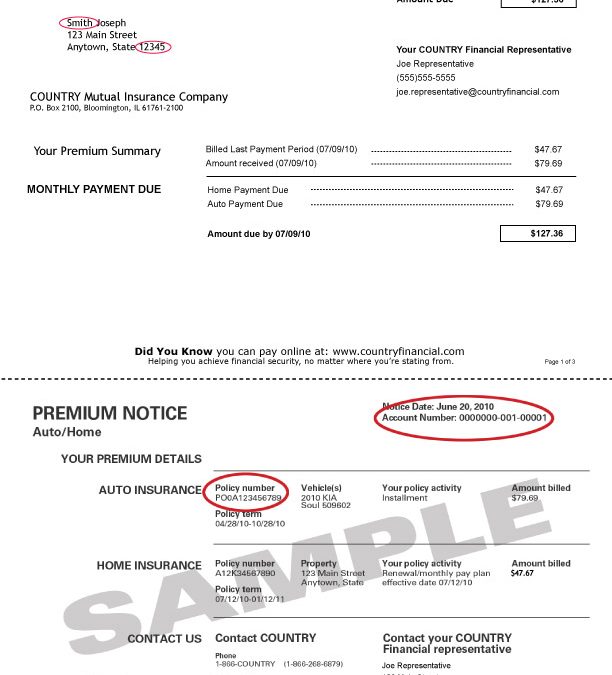

Month to Month Payments

Not everyone pays their insurance premium in one lump sum. Say you break your $600 premium into $100/month. Adding a second car is going to make your monthly payment increase to $150. If you add the second car 3 months into your term, you only have to pay for months 3 through 6. If you add your second car right before, or after your invoice is generated, the change will not reflect till your next billing statement. This is because it takes about 21 days for a change to process. To cover the month your car was added and the next billing statement, you will pay 2 payments. So instead of paying your normal $150, will pay $200. Then the following month your statement will go back down to $150.

There is no exact calculator to determine what your prorated rates will be. Your insurance company will not know the premium amount until your paperwork has been processed. The estimate is based on your 6-month premium divided by 6. But the actual billing can still differentiate.

Prorated Premium vs. Earned Premium

The prorated premium is a change made mid-term of your policy. Earned premium is when you have added a vehicle to your policy but your coverage either lapses or is canceled. You only pay for the number of days your added car was covered by your policy.

Keep in mind we are only covering a very basic understanding of your prorated insurance rates. For a more in-depth explanation of any prorated changes on your insurance coverage, make sure you call your Compass Insurance agent today at 616-245-5555. Not with Compass, it is okay. We would still love to help, give us a ring at 616-245-5555.