As soon as you type in, “Millennials are” in Google, a whole list of everything Millennials are doing ‘wrong’ appears. But did you know they are also doing Insurance wrong? Yes. While the number of Millennials is starting to surpass the number of Baby Boomers, they are also the least insured generation. But why is that? What is making Millennials Forsake Insurance?

Emerging Adulthood

Millennials are like boomerangs. They are the generation to grow up with their parents taking care of everything. Most leave for college around 17 or 18, but end up moving back home with their parents as soon as they graduate. Between the cost of student loans and entry level pay, more and more are doing it. But it also means going back on mom and dad’s dime.

With Affordable Care Act, they can stay on their parent’s insurance until the age of 26. This means they are already starting of adulthood still dependent on their parents. There is no age limit for car insurance and as long as they are living under their parents room, they are covered under homeowner’s insurance.

Relationships

Gallup wrote an article on how Millennials operate with Insurance companies and how to improve that relationship.

Family is very important to Millennials. Much of how they decide their business is based on who their parents and grandparents have worked with. This can be good for insurance companies as they not only acquire new customers, but gain the trust of entire families.

Ease. Millennials are the generation that grew up with the technology age and they want information right this second. They like to make changes and updates instantaneously with the touch of a button. They prefer this rather than seek out an agent and talk to them unless they absolutely have to. It is important as the agency to make sure they have the capacity to allow these possibilities.

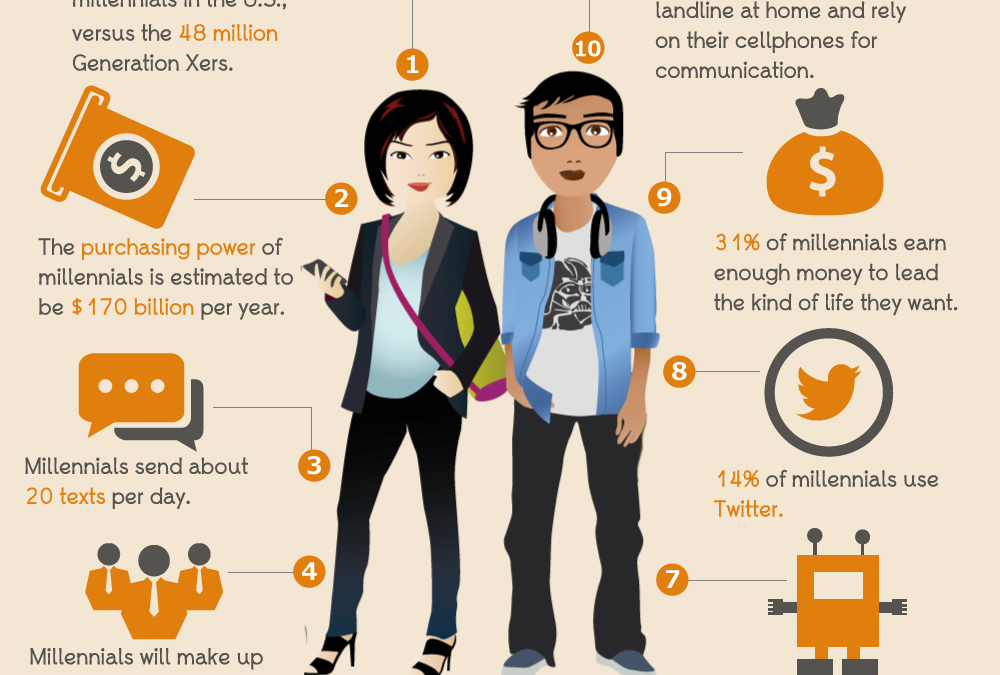

It is also important to this generation to be able to research questions they have just as quickly. One way to go about this is have a live-chat, or allow the Millennial to quickly text their agent. In fact, much communication today is done through texting.

The Stats**

Auto Insurance: ” 64% of millennials have auto insurance, compared to 84% of older generations. Many millennials may have decided to skip car ownership. But if you rent a car or borrow one from your roommate, you have liability.”

Homeowner’s & Renter’s Insurance: “10% of millennials have homeowners insurance, compared to more than half of those aged 30 to 49 and 75% of those 65 and older. Fewer millennials own a house, for sure. But this generation isn’t buying renters insurance either: only 12% have it…”

Disability Insurance: “13% of millennials have disability insurance, compared with 37% of those 30 to 49. This kind of coverage […] may seem unnecessary. Yet one in three working adults will miss at least three months of work at least once in their life due to illness…”

Life Insurance: “36% of millennials have life insurance, compared with 60% of those 30 to 49.”

Interested to see what else Millennials think about insurance? You can read the study the Griffith Insurance Education Foundation put together HERE.

What We’re Doing

Compass works to shift the way they do business as society does. We service many of our clients through text messages including writing up policies and submitting claims. Some of our carriers have apps for your phone where you can pay your bill and look up your coverage at the tip of your fingers.

Family is also just as important to us. Much of our business comes through word of mouth and as a result we have entire families and their friends coming in to see what we can do for them. We encourage this program by making a $10 donation for every referral that comes in to the charity we’re working with each quarter.

See what else we are doing to service Millennials all across Michigan and make sure you have the right insurance coverage for your needs. Call us today!